&TEAM ペンライト トレカ9枚付

(税込) 送料込み

商品の説明

エンチームのペンライトです。ウィバースショップで購入しました。

一回のみ使用しましたが、それ以外は箱に入れてしまっていたので綺麗かと思います。が、完璧を求める方は遠慮くださいませ。

箱のスレや小傷はペンライトが到着した時から既についておりましたのでご了承ください。

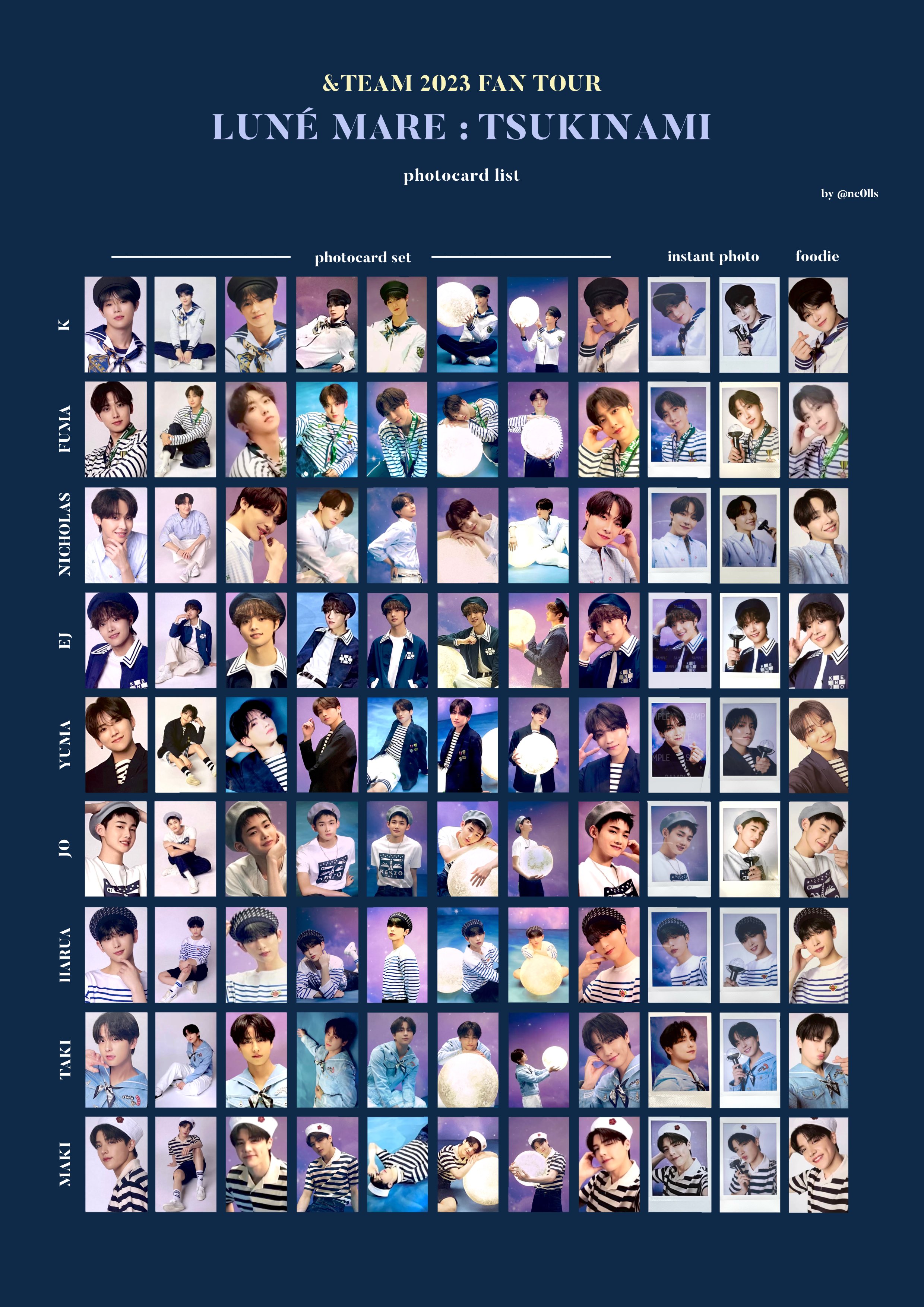

トレカは全て揃っています。

バラ売りはしません。商品の情報

| カテゴリー | 本・音楽・ゲーム > CD > K-POP/アジア |

|---|---|

| 商品の状態 | 目立った傷や汚れなし |

Amazon.co.jp: &team ペンライト トレカ 9枚セット 全員 : おもちゃ

Amazon.co.jp: &TEAM ペンライト トレカ ペンラ : おもちゃ

Amazon.co.jp: &team andTEAM ペンライト トレカ : おもちゃ

Amazon.co.jp: &TEAM ペンライト 購入特典 トレカセット : おもちゃ

&team ペンライト - K-POP/アジア

&TEAM ペンライト封入 トレカ 9枚

Amazon.co.jp: &TEAM ハルア トレカ ペンライト ソロジャケ セット

![駿河屋 -<中古>[単品] &TEAM フォトカード9枚セット OFFICIAL LIGHT](https://www.suruga-ya.jp/database/pics_light/game/892195454.jpg)

駿河屋 -<中古>[単品] &TEAM フォトカード9枚セット OFFICIAL LIGHT

u0026TEAM ペンライト - アイドル

&TEAM andteam バインダー トレカ JO ジョー - K-POP/アジア

Amazon.co.jp: &team ペンライト トレカ 9枚セット 全員 : おもちゃ

u0026TEAM ペンライト - アイドル

公式 新品未開封 】&Team ペンライト フルセット andteam|mercari

&TEAM - &TEAM 公式ペンライト、トレカの通販 by リサリサ's shop

2023年最新】エンチーム ペンライトの人気アイテム - メルカリ

Amazon.co.jp: &TEAM ペンライト トレカ ペンラ : おもちゃ

![駿河屋 -<中古>[フォトカード・ダストバッグ欠品] &TEAM OFFICIAL](https://www.suruga-ya.jp/database/pics_light/game/560199900.jpg)

駿河屋 -<中古>[フォトカード・ダストバッグ欠品] &TEAM OFFICIAL

u0026TEAM ペンライト www.sudouestprimeurs.fr

ファッションの &team ペンライト K-POP/アジア - ritualteatr.az

u0026TEAM ペンライト - アイドル

&TEAM ケイ トレカ(ペンライトトレカ)

卸し売り購入 &TEAM ニコラス トレカセット 3rdEP K-POP/アジア

&TEAM ペンライトの通販 by peaches |ラクマ

&TEAM トレカ - K-POP/アジア

2023年最新】andteam ペンライトの人気アイテム - メルカリ

激安大特価! &TEAM NICHOLAS トレカ K-POP/アジア - abstech.ae

EJ ウィジュ サイン ユニバ &TEAM トレカ セルカ ラキドロ エン

2022激安通販 &TEAM トレカ YUMA アイドル - www.coubeche.com

&TEAM ジョー トレカ(ペンライトトレカ)

Amazon.co.jp: &team andTEAM ペンライト トレカ : おもちゃ

出産祝いなども豊富 TWICE CANDYBONG ペンライト 動作確認済み トレカ

&TEAM - &TEAM 公式ペンライト、トレカの通販 by リサリサ's shop

andteam &team トレカ | www.carmenundmelanie.at

福袋 &TEAM ハルア トレカ フーディー 月波 K-POP/アジア - rastgar-co.com

2023年最新】&team ペンライトの人気アイテム - メルカリ

YUMA【公式】&TEAM ペンライト - K-POP/アジア

TEAM ペンライト - その他

&TEAM 1stAlbum weverse global 限定トレカ JO 【爆売り!】 10889円

本物の ユニバ NOW &TEAM ラキドロ 特典 購入 セット 9枚 コンプ

駿河屋 -<中古>&TEAM OFFICIAL LIGHT STICK(ペンライト)(その他)

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています