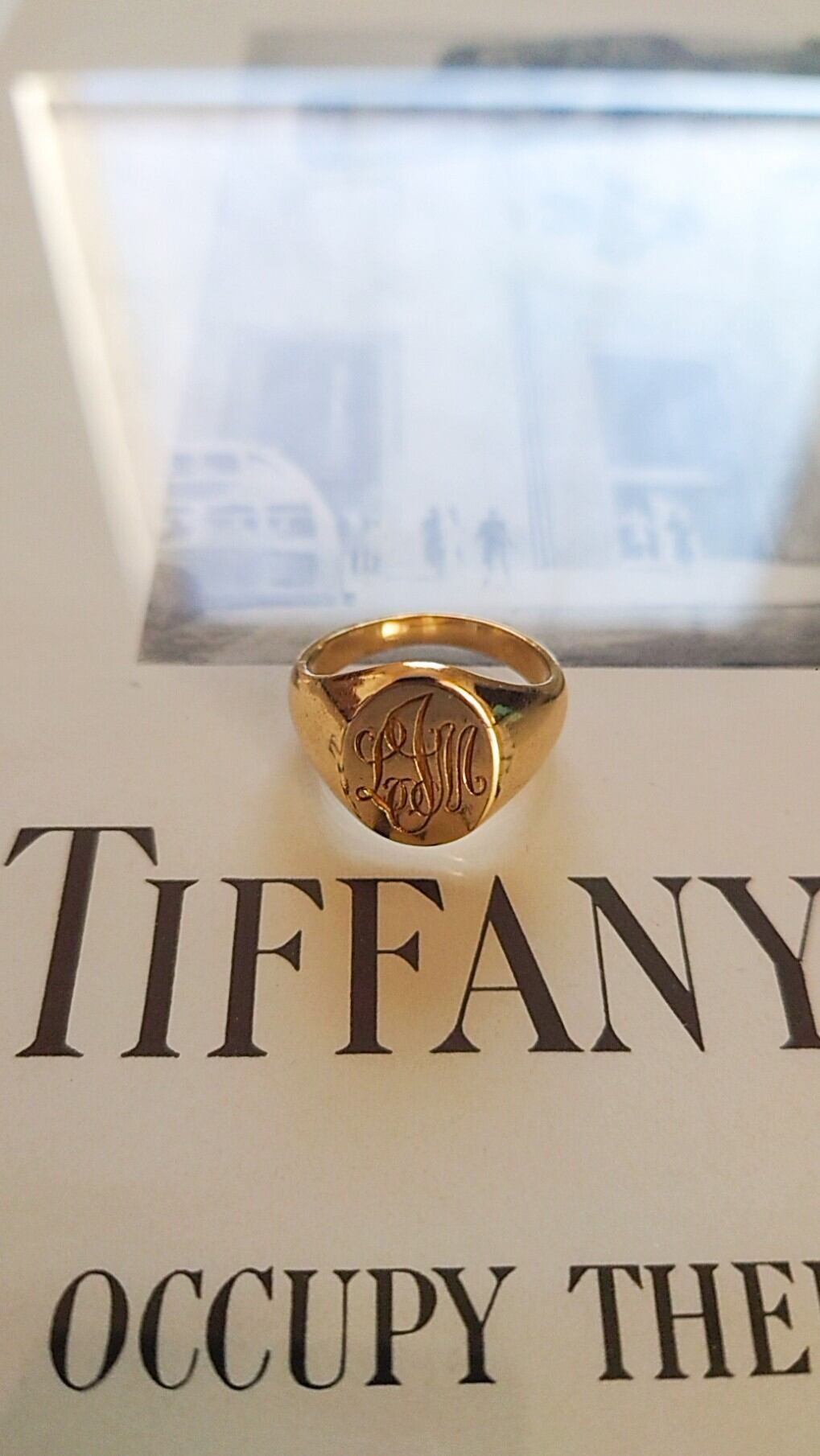

Tiffany シグネットリング

(税込) 送料込み

商品の説明

コレクション整理のため出品します。

以前こちらでお譲りいただきました。

サイズは10号になります。

質問などあればコメントにお願いします。商品の情報

| カテゴリー | メンズ > アクセサリー > リング |

|---|---|

| ブランド | ティファニー |

| 商品の状態 | やや傷や汚れあり |

Tiffany vintage ティファニー ヴィテージ シグネットリング - リング

VINTAGE TIFFANY & CO. Oval Signet Ring Sterling Silver

VINTAGE TIFFANYヴィンテージティファニー シグネット リング9.5

Tiffany vintage ティファニー ヴィテージ シグネットリング - リング

VINTAGE TIFFANY ヴィンテージ ティファニー シグネット リング-

通販 人気】 & Tiffany Co. シルバー×オニキス シグネットリング

SPECIAL / VINTAGE】TIFFANY&Co. ティファニー K18 ホワイト ゴールド

VINTAGE TIFFANY ヴィンテージ ティファニー シグネット リング-

100%新品2023 Tiffany & Co. - VINTAGE TIFFANY ヴィンテージ

Tiffany & Co. - VINTAGE TIFFANYティファニー 14KゴールドVS

VINTAGE TIFFANY ヴィンテージティファニー シグネットリング#10

シグネット リング | Tiffany & Co.

TIFANYティファニービンテージシグネットリング - リング

シンプル 18K ティファニー スクエアシグネットリング シルバー

VINTAGE TIFFANY シグネットリング ヴィテージティファニー 売れ筋がひ

楽天市場】ティファニー リング Tiffany メンズ・レディース 1837

大評判の-Tiffany & Co. - VINTAGE TIFFANY ヴィン•テー•ジ

Tiffany シグネットリング 11号-

価格タイプ ビンテージティファニー シグネットリング 9.5号

Tiffany & Co./ティファニー】よりシグネットリングを買取入荷致しまし

TIFANYティファニービンテージシグネットリング - リング

2023年最新】Yahoo!オークション -ティファニー シグネットリングの

国内発すぐ届く☆Tiffany&Co. メイカーズ シグネット リング (Tiffany

ティファニー 1837™ メイカーズ シグネット リング スターリング

SPECIAL / VINTAGE】TIFFANY&Co. ティファニー K18 イエロー ゴールド

VINTAGE TIFFANY ヴィンテージティファニー シグネットリング#10

ホットスタイル ティファニー シグネットリング リング

VINTAGE TIFFANY ヴィンテージ ティファニー シグネット リング-

TIFFANY&Co. ティファニー / BLACK ONYX SIGNET RING : オニキス

OLD TIFFANY & CO. Black Onyx Daisy Signet Ring Sterling Silver

希少 Tiffany\u0026Co ティファニー シグネット ハート リング 13号

2023年最新】シグネットリング ティファニーの人気アイテム - メルカリ

ティファニー スクエアシグネットリング 8号 - リング(指輪)

Tiffanyティファニー ハートシグネットリング - リング

から厳選した & Tiffany Co. シルバー×オニキス シグネットリング

Tiffany シグネットリング-

VINTAGE TIFFANY ヴィンテージティファニー シグネットリング#10-

ティファニー TIFFANY & CO. ヴィンテージ エルサペレッティ

Tiffany シグネットリング 11号 | www.innoveering.net

Tiffany & Co. - VINTAGE TIFFANYティファニー 14KゴールドVS

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています